Tulip Mania

Here’s the situation. We’re in the 1590’s, in the Dutch Republic, aka the United Provinces (modern day Netherlands). Since the 1550’s, tulips had first been introduced into Europe from Turkey (they grow in many regions in Central Asia, but it became popular in Turkey in the 1500’s).

These were some of the most beautiful flowers that the Europeans had ever seen.

So for 40 years, these beautiful flowers were only possessed by the rich. They would plant them in their gardens to demonstrate their wealth. However, the arrival of these flowers also coincided with The Netherlands’ independence from Spain (which happened in 1582, and which was mainly due to their invention of an early form of capitalism), after which the country prospered economically in a period called the Dutch Golden Age (which roughly spanned the 17th century) (1). The middle class in the country was growing in size, and the flower naturally became a status symbol (it’s something the rich already possessed, and so if you want to seem rich, now’s your chance). These people were willing to pay a lot just to get their hands on the newest, the latest, and the most spectacular-looking tulips (consumption/materialism basically).

One day, some dutch (actually Flemish, but same thing) botanist planted a bunch of tulip bulbs (seeds) in his garden, and noticed that these flowers could survive in the harsh conditions of the Netherlands.

These flowers were touched by a disease which would change their color. This caused the petals to display flame-like multicolored stripes.

Although this was a disease, which is NOT a good thing, this introduced even more variety to an already unique-looking flower, and made these flowers more desirable to a population who were unaware of the disease.

Note that tulips are not easy to breed. It takes 10 years for a seed to grow into a flower. As the seed grows, it gives off bulbs which can be collected a few times a year, and which take 3 years instead of 10 to mature. Another characteristic of these flowers is that they blossom during the months of April and May. In that form, the flowers cannot be moved. You would have to wait until summer for them to retrieve into their bulb form. This gives a limited window of time to trade and move the bulbs.

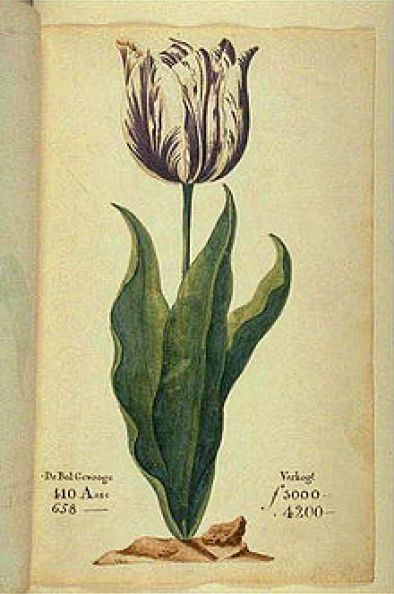

A painting of a “Viceroy”, a type of tulip which, at the peak of the bubble, was worth 10 times more than what a skilled worker made in a year. That’s like it being worth $300’000USD today. For just one.

Now imagine this scenario. It’s mid-April, 1634, the sun is shining, and I have a beautiful multi-color and striped tulip in my backyard. I randomly bought it from someone else as a bulb. You, the reader, saw it and wanted to buy it. I want to sell it and make a profit. But the flower is blossomed, and pulling it out of the earth would kill it. So I can’t sell it right away, but what I could do instead, is sign a contract promising that I will sell it to you in the future. In finance, this is a derivative/contract called “futures contract”. These contracts allowed for the tulip bulbs to be traded much more quickly.

Back to the story: so you pay me 2000 florins for it (the currency), and I give you a signed futures contract. But you’re smart (I know it because you got thus far into this article). You know that you can buy this bulb, and sell it for even more to one of your acquaintances. You don’t have the physical bulb yet, but that doesn’t matter, because you know you’ll get it. It says so in the contract which I signed.

So what you do is you promise your acquaintance of a future sale of the tulip. And maybe he does the same to someone he knows. Now, people are not buying the flowers to own the actual flowers, but because they just want to make money. Everyone just speculated on the future price of the tulips being higher than the price that they paid for them. Fortunately, at some point, common sense does kick in, and people aren’t willing to pay the crazy amount for a tulip bulb.

This is exactly what happened in February of 1637. Auctions had been ongoing in these times, and tulips had been selling like crazy. But, one day, in one particular tulip auction in a city called Haarlem, no one showed up to buy the tulips (2).

And just like that, overnight, the price of these flowers plummeted, as people desperately tried to sell their flowers. More specifically, as more and more traders were selling, they had to lower their prices to compete with each other. And as the prices go even lower, even more people want to get rid of their bulbs, which then drives prices even lower (3).

Often considered to be the first ever economic bubble, the “tulip mania” is a basic case and an easy to understand one with not too many variables (contrasted with our more complex world of today). To summarize and possibly clear things up, a bubble occurs when your friend tells you that he bought something, and made a profit by selling it at a higher price. So you do the same as him, and sell it for even more. At this point, everyone hears of the opportunities of making easy money here. Knowing about the actual value of the item does not matter anymore. The trend is just too good to ignore. You buy low, and sell high. Everyone’s been doing it for the past few months or years… until, one day, there are no more buyers. People suddenly realize that they don’t actually want to spend that much money on this object. The price of that item hence crashes. This marks the burst of the bubble. And like all bubbles to date, they must burst at some point.

A bubble begins at the point when the item starts selling for more than its intrinsic value. Although it’s hard to pinpoint the real worth of something, it is easier to spot when things get ridiculous. And herein lies the danger of bubbles, we only spot them when it’s too late.

It is important to note that all this happened in the 1600’s. There is very limited economic data from that era, and not everything is necessarily true. But that doesn’t matter. The tulip mania teaches us valuable lessons nonetheless.

Note:

(1)

The Netherlands were able to improve their naval power, which gave rise to Dutch East India Company, which is the first known corporation. This led to the first ever stock market to be located in Amsterdam.

(2)

A this time, there was a plague outbreak, and this is a possible reason for no one to show up. Some even argue that it was because of this plague outbreak that the tulip mania started, as people thought they were going to die anyway, so didn’t mind paying a lot of money for a flower. YOLO right?

(3)

Something crafty that some sellers tried to do is take a horse to the nearest city, and sell all their now-worthless bulbs over there, before that city found out about the price drop in Haarlem. Within four days, the crash which occurred in Haarlem touched the entire country. High Frequency Traders do something similar today, building their IT location as close as possible to the exchange in order to receive the data faster. Every microsecond counts today.

Sources:

https://en.wikipedia.org/wiki/Tulip_mania http://www.youtube.com/watch?v=-livicJXWDk http://www.youtube.com/watch?v=I5ZR0jMlxX0